What Is A Calendar Spread – A calendar spread, as the name suggests is a spread strategy wherein you trade on the gap between two similar contracts rather than betting on the price. This is considered to be relatively low . The basic rule of thumb is that you buy into a calendar spread where the break even point is no more than a 10 percent difference. That is, the long-term premium is no more than 10 percent higher .

What Is A Calendar Spread

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

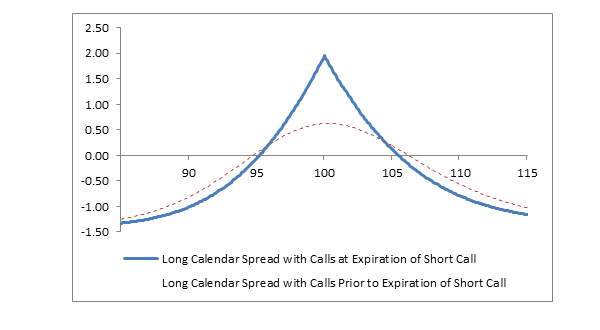

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

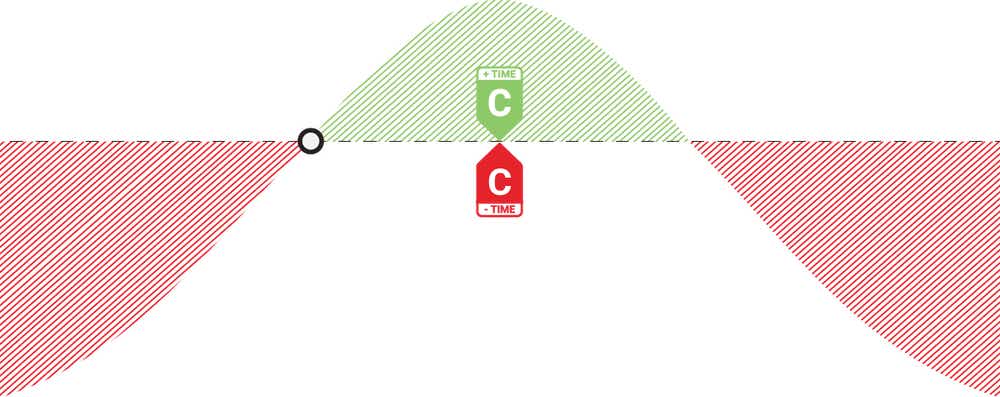

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

Long Calendar Spreads for Beginner Options Traders projectfinance

Source : www.projectfinance.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

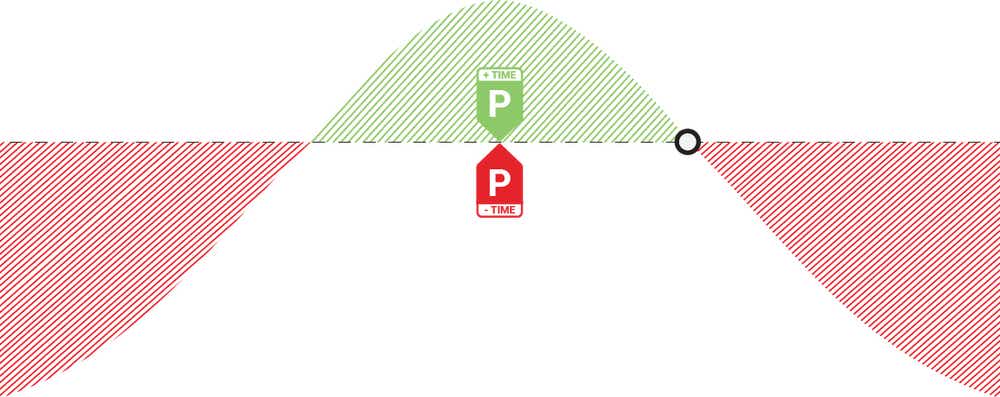

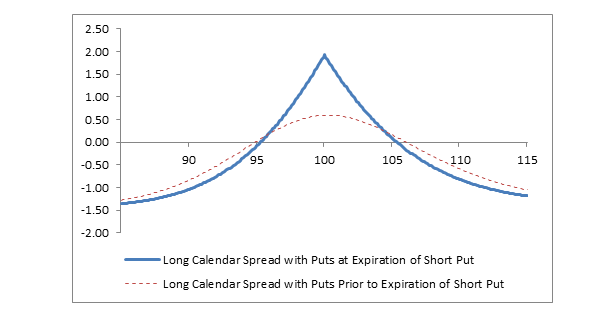

Long Calendar Spread with Puts Fidelity

Source : www.fidelity.com

Getting Started with Calendar Spreads in Futures Exegy

Source : www.exegy.com

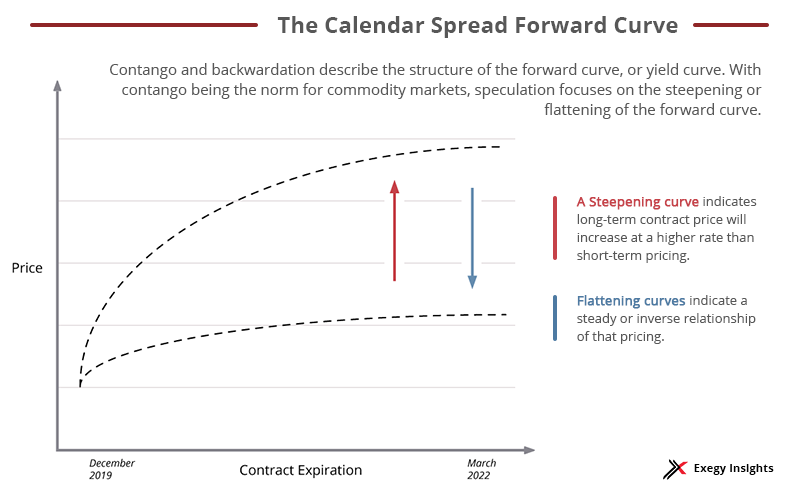

What Is A Calendar Spread Calendar Spreads in Futures and Options Trading Explained: Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . Charting, Price Performance, News & Related Contracts. .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)